In the early days of SaaS, the "Per-Seat" (or Per-User) pricing model was a revolution. It replaced complex server licensing with a simple, predictable formula: Number of Employees × Monthly Rate = Total Cost. For tools like email (Google Workspace) or CRM (Salesforce), where usage is daily and uniform, this model works perfectly.

However, applying this same logic to e-signature software is a fundamental category error. Unlike email, e-signature usage is inherently episodic and asymmetrical. A recruiter sends 50 offer letters a month; a department head signs one budget approval a year. Yet, under a standard per-seat contract, the organization pays the exact same $40/month for both.

This article dissects the financial inefficiency of user-based licensing in utility software and exposes the "Shelfware Gap" that vendors rely on to boost their margins.

The Core Conflict

Per-seat pricing incentivizes scarcity. To save money, IT teams restrict access, sharing logins or forcing users to route requests through a central "admin." This creates bottlenecks that defeat the very purpose of digital transformation: speed and autonomy.

The Seat Utilization Gap

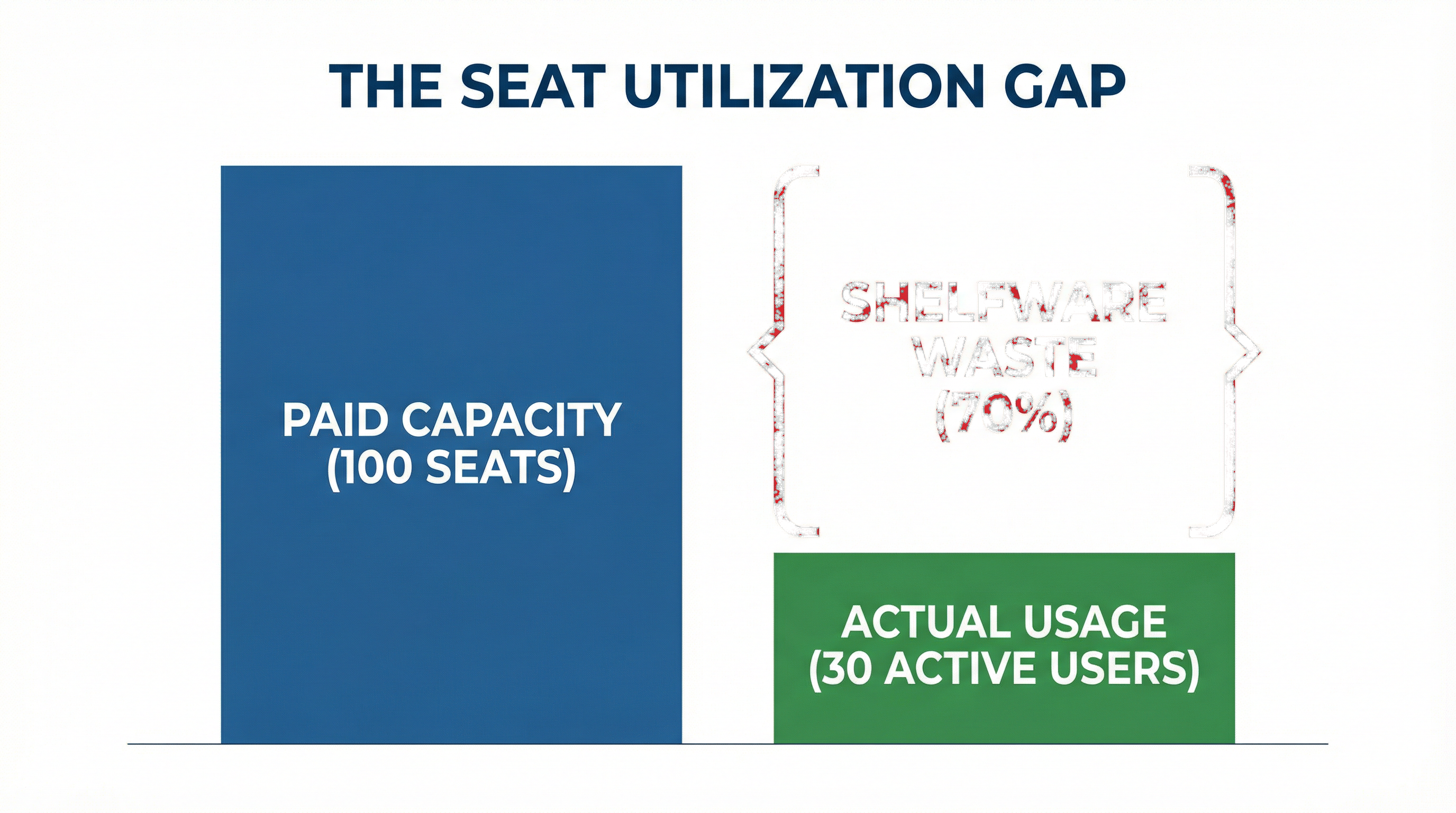

When a company buys 100 seats of an e-signature tool, they are purchasing 100% theoretical capacity. In reality, audit data consistently shows that only 20-30% of those seats are "active senders" in any given month. The remaining 70% are "shelfware"—licenses that are paid for but sit idle.

This waste is not accidental; it is structural. Vendors know that if they sold you a "consumption-based" plan (paying only for envelopes sent), their revenue would drop by the exact percentage of that waste. The per-seat model effectively subsidizes the vendor's revenue stability at the expense of your budget efficiency.

The "Occasional Sender" Penalty

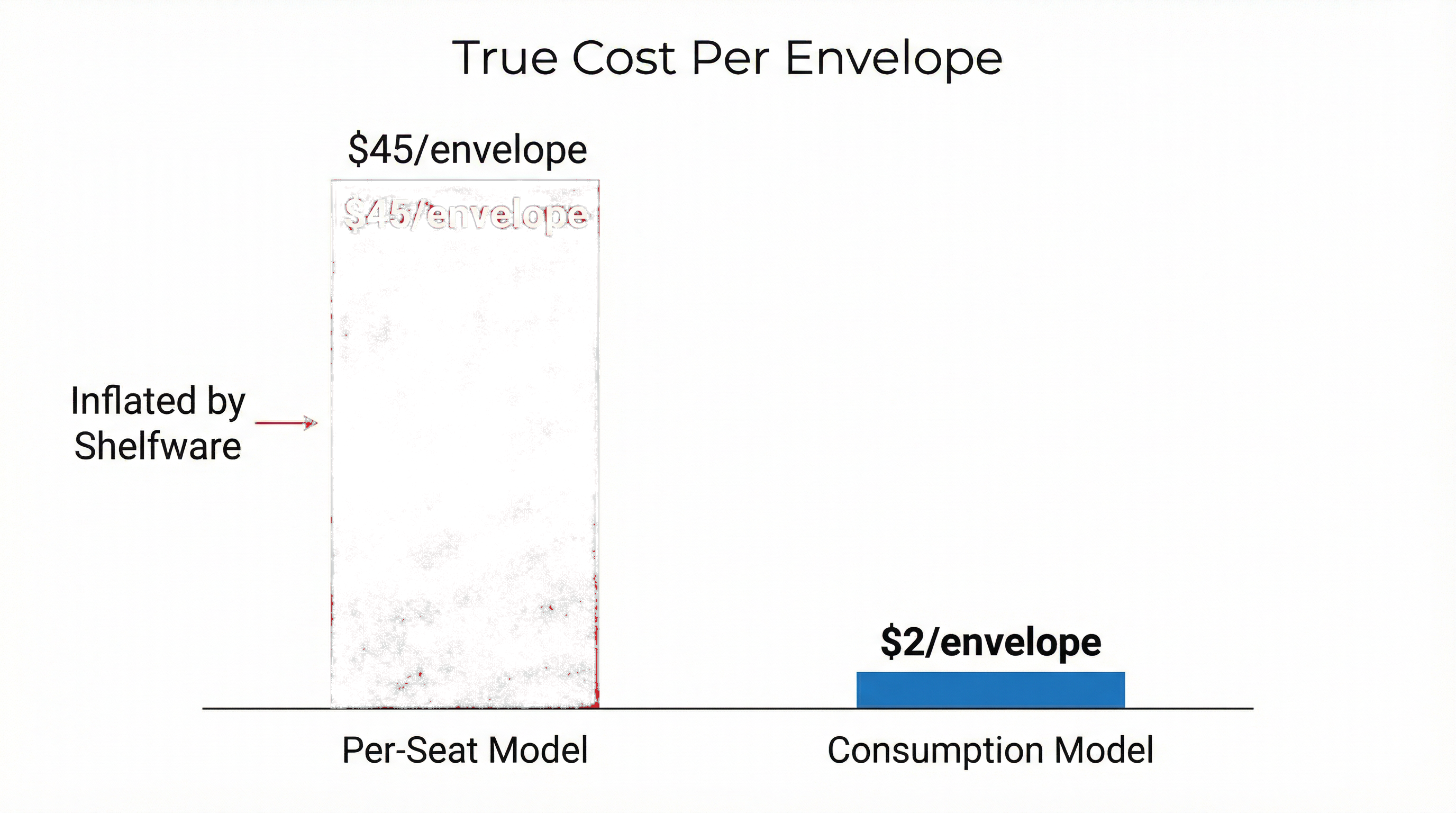

The math becomes even more punishing when you calculate the Effective Cost Per Envelope (ECPE).

Consider a "Business Pro" plan at $45/user/month ($540/year).

- The Power User: Sends 500 docs/year. ECPE = $1.08. (Great value).

- The Occasional Sender: Sends 12 docs/year (one per month). ECPE = $45.00. (Exorbitant).

In most organizations, "Occasional Senders" outnumber "Power Users" by a factor of 5 to 1. This means the weighted average cost of your contract is likely 10x higher than the market rate for a simple digital signature.

Strategic Alternatives

As detailed in our Strategic Guide to Procurement, the goal is to align cost with value. You should not be paying for the potential to sign; you should pay for the act of signing.

The Strategy: Negotiate a contract where you provision 500 users but only pay for the 100 who actually log in or send a document that month. This "True-Up" approach eliminates shelfware risk.

The Strategy: Switch to an API-first or consumption-based vendor (like Dropbox Sign or BoldSign) where you buy a bucket of 10,000 envelopes shared across unlimited users. This democratizes access without penalty.

Consultant's Verdict

If your organization has a centralized team (e.g., HR or Sales Ops) doing 90% of the sending, a Per-Seat model may still be viable. But for any company aiming for "digital-first" culture—where every manager, lead, and director can execute agreements autonomously—the Per-Seat model is a financial trap.

Don't let a vendor's pricing model dictate your operational efficiency. If they can't offer an Active User or Consumption option, they are likely profiting from your inefficiency.