Procurement teams often fixate on the "price per envelope" or "price per seat" line item, assuming that covers the core functionality of getting a document signed. This assumption holds true for basic internal workflows where an email link is sufficient authentication. However, as soon as a workflow touches external parties, high-value assets, or regulated industries, the need for higher assurance levels triggers a secondary, often invisible, pricing menu.

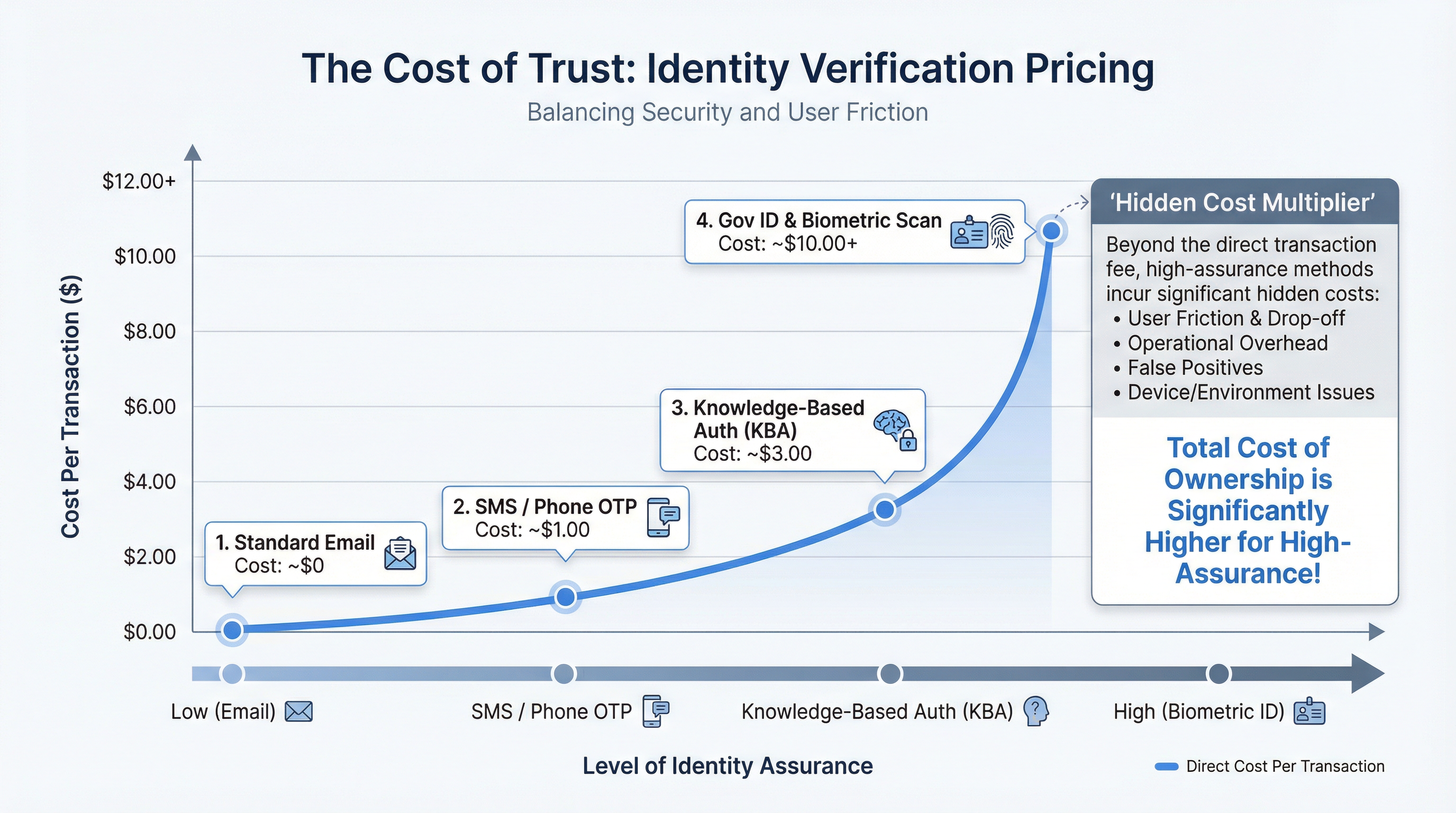

Advanced Identity Verification (IDV) methods—such as SMS One-Time Passwords (OTP), Knowledge-Based Authentication (KBA), and Government ID Scanning—are almost never included in the base subscription price. They are billed as "consumption-based add-ons," and their costs scale linearly with volume, creating a significant budget variance risk that is typically discovered only after the contract is signed and the first quarterly invoice arrives.

The "Per-Attempt" Pricing Trap

The most dangerous nuance in IDV pricing is the distinction between "per transaction" and "per attempt." A standard e-signature envelope is consumed only when sent. Identity verification fees, however, are often triggered every time the service is called.

If a signer fails their Knowledge-Based Authentication quiz (a common occurrence when credit bureau data is outdated) and retries three times, you are not billed for one verification; you are billed for three. In high-friction workflows, such as consumer lending or patient onboarding, failure rates for KBA can range from 10% to 15%. This "failure tax" is rarely modeled in the initial ROI calculation.

Standard KBA Pricing

- •$1.00 - $3.00 per attempt

- •Billed regardless of success/failure

- •Requires 3rd-party data (Equifax/TransUnion)

The "Failure Tax" Reality

- •15% average failure rate for KBA

- •Users often retry 2-3 times before giving up

- •Real Cost: Can be 3x the quoted rate

SMS Authentication: The "Low Cost" Leak

SMS Two-Factor Authentication (2FA) is often viewed as a cheap security upgrade, typically priced between $0.25 and $1.00 per transaction. While individually inexpensive, the volume multiplier is deceptive.

For a B2C company sending 10,000 agreements a month, adding SMS authentication adds a minimum of $30,000 to $120,000 in annual recurring cost—often doubling the total contract value. Furthermore, telecom regulations in certain regions (like the EU or parts of Asia) have driven up the wholesale cost of SMS delivery, leading vendors to pass these increases directly to customers through "carrier surcharges" that are excluded from the base rate.

Strategic Procurement Recommendations

To mitigate these hidden costs, procurement leaders must decouple the "platform" negotiation from the "verification" negotiation.

1. Demand "Per Successful Transaction" Pricing: Negotiate terms that bill only for successful verifications. Vendors will resist this, as they still pay their data providers for failed checks, but large-volume buyers can often secure this concession to cap their downside risk.

2. Pre-Purchase Verification Bundles: Instead of paying the "pay-as-you-go" rate (which is always the highest tier), pre-purchase a bucket of SMS or KBA credits annually. This can secure discounts of 20% to 40% off the list price.

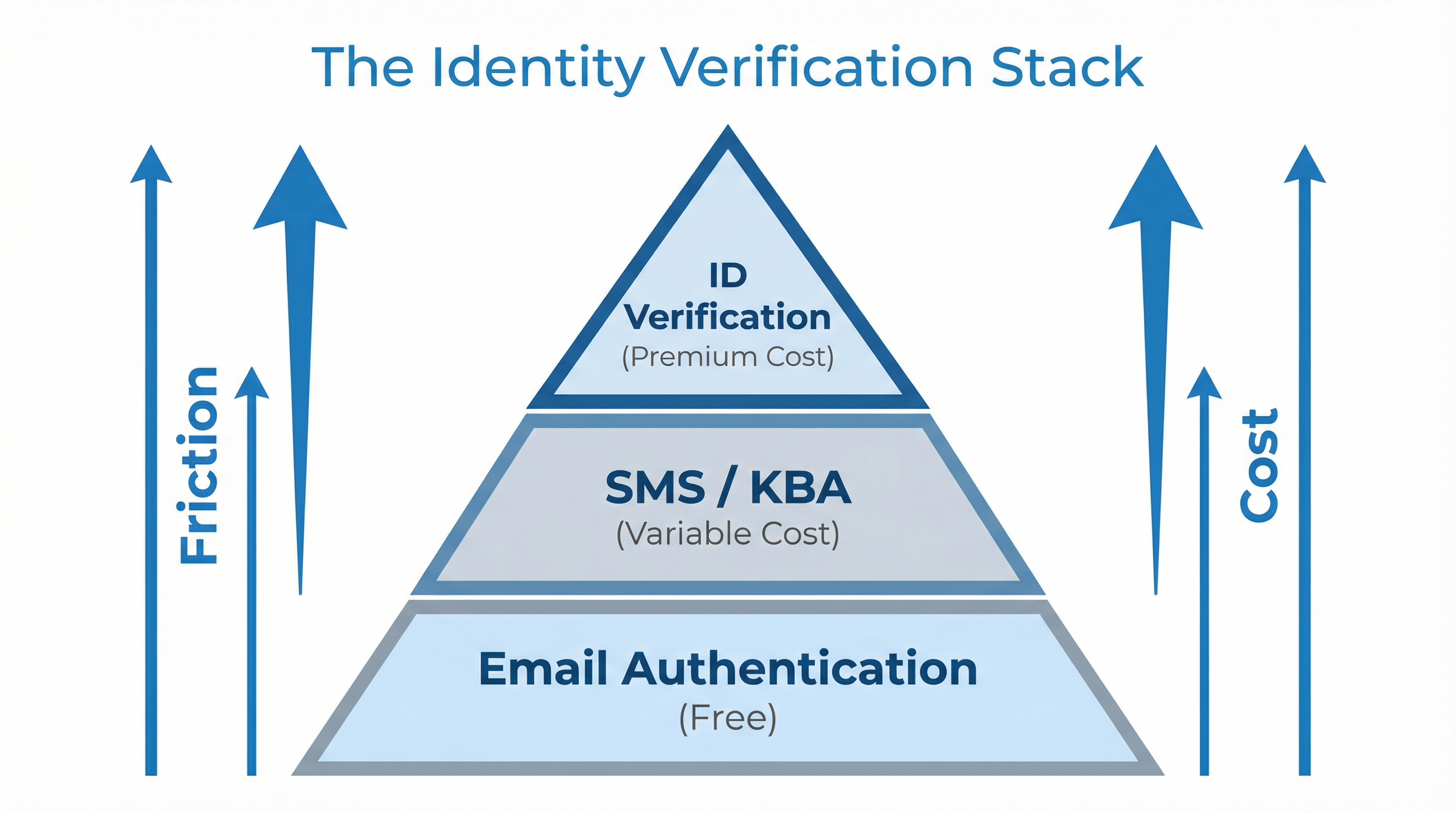

3. Implement Step-Up Logic: Do not apply high-assurance verification to every envelope. Configure your workflow to default to email authentication, and only trigger SMS or ID verification for documents above a certain dollar value or risk threshold. This "dynamic friction" approach optimizes both user experience and budget.